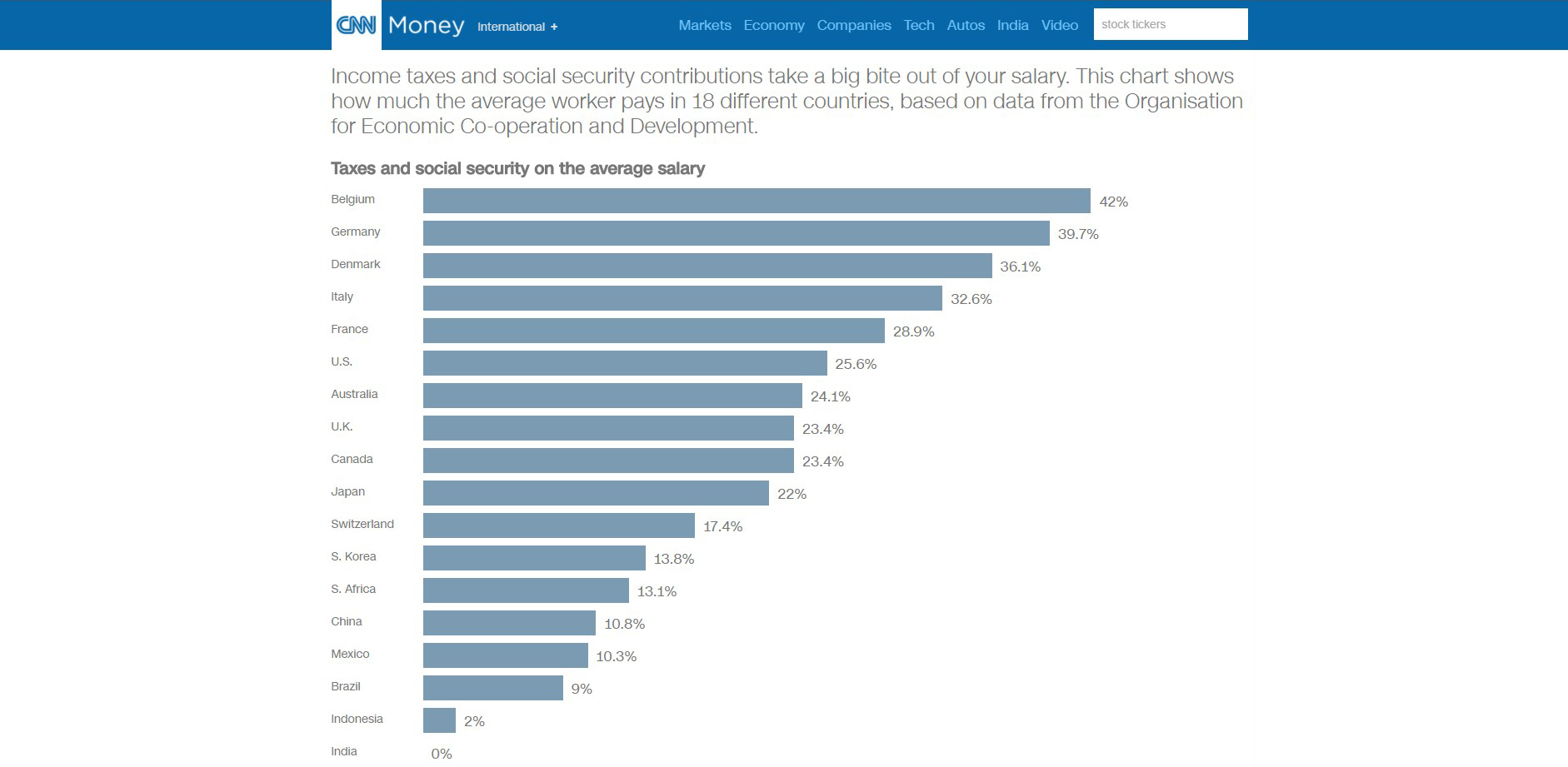

As recently reported by CNN “Everybody moans about paying their taxes, but Belgians have more reason than most to complain. Data from the Organisation for Economic Co-operation and Development shows that Belgium has the highest income taxes in the developed world.”

All of this means Belgium is a special case and there is a very high tax and social security burden for salaried employees. The table below gives some scenarios on net remuneration versus cost to employer of salaried employees.

| Employer cost | 133,701 | 159,670 | 186,288 | 212,906 | 239,524 | 266,142 |

| Gross remuneration | 100,000 | 120,000 | 140,000 | 160,000 | 180,000 | 200,000 |

| Net remuneration | 48,589 | 56,678 | 64,795 | 72,817 | 80,936 | 89,055 |

| % net/total costs | 36.50% | 35.50% | 34.78% | 34.20% | 33.79% | 33.46% |

As often on higher salaries, the employee might receive one third net of gross salary, while most agencies employs their senior staff on an independent basis.

The social security amount on top of income tax to be paid by an individual is calculated based on gross salary but is around 13 percent, while employers’ contributions account for around a third as a salaried employee, as the table shows below:

| Type of insurance | Paid by employer | Paid by employee | Total | |

|

White collar workers |

||||

|

1-9 employees |

32.94% |

13.07% |

46.01% |

|

| 10-19 employees | 34.63% | 13.07% | 47.70% | |

| 20+ employees | 34.65% | 13.07% | 47.72% | |

However for independents the overall social security burden is considerably lower and the contributions are capped at €16,616 per year, or €3,904 per quarter for people earning over €82,000 per year, which is more or less the salary from where consultants should consider becoming independents.

Paying bonuses based on KPIs may be a useful way to give additional incentives but bonus taxation is very high in Belgium for salaried employees, but is not taxed differently if given as additional fees to independents.